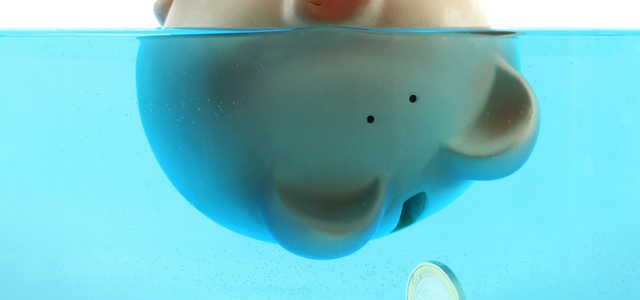

Helpful Tips to Pay off Student Loans Faster

For the past few weeks’ South African universities were under siege by students protesting increasing tertiary fees and student debt – until President Zuma stepped in and made an official statement that no fee rise will be enforced next year. While campuses are calming down and some classes are back to normal, the ever-present issue