By Dr. Roelof Botha, Economic Advisor to the Optimum Investment Group

Russia’s invasion of Ukraine is causing an extension of Covid-induced supply-side disruptions around the globe, with airfreight charges between Europe and Asia already increasing at a rate of knots.

The international financial system is now facing a liquidity risk due to the freezing of Russian-controlled dollars. Major Russian banks have also been removed from the crucial SWIFT interbank messaging service, which could lead to missed payments and large overdrafts similar to the situation that existed during the start of the Covid pandemic.

Although the events in Ukraine may seem like a distant war that does not affect African countries, there are some concerns over food security. Russia and Ukraine are major exporters of agricultural products to Africa, especially wheat and maize.

The most immediate negative consequence for all countries, including South Africa, is the sharp rise in the oil price, namely by almost 70% in the space of only three months. This will translate into higher fuel prices and place upward pressure on the consumer price index. As an inference, it is almost inevitable that the Reserve Bank will raise interest rates again at the next meeting of the Monetary Policy Committee, scheduled for 8 June.

The message to consumers is clear: credit is slowly but surely becoming more expensive, so caution should be exercised with household budgets.

According to Carla Oberholzer, debt adviser, spokesperson, and registered debt counsellor at DebtSafe:

“Many South African consumers are already feeling the pinch and are seeking options to overcome their debt burdens. Debt Review is a regulated and legal solution under the National Credit Act (“the Act”) that over-indebted consumers (still receiving an income and not making ends meet) can consider to take back control of their debt and their finances.”

Growth drivers abound

On the positive side, there is little doubt that the South African economy has built up some momentum after last year’s splendid growth performance. Several key sectors of economic activity, including tourism, are bound to recover fully in 2022 and international tourists are returning to our shores in droves.

South Africa is also fortunate to possess a highly sophisticated and productive agriculture sector, which managed to generate record export sales of R144-billion in 2021. The country’s overall trade balance followed a record-breaking international trade performance, notching up a surplus of R336-billion.

Other good news is that the country’s renewable energy programme is on track again. During the last week of October, the government finally announced the names of the preferred bidders for the latest round of the programme. The 25 winning bidders are expected to build almost 2,600 MW of new generating assets for introduction into the country’s power-stressed grid within the coming 36 months. The projects have a combined investment value of R50-billion.

Evidence that South Africa has entered a new sustained growth phase can be found in positive trends for a variety of leading economic indicators and indices of business confidence. They include the following:

- The IHS Markit PMI, which includes the manufacturing and services sectors and has remained above the neutral level of 50 for the longest duration in several years

- Absa’s Purchasing Managers’ Index (PMI) for the manufacturing sector, compiled by the Bureau for Economic Research (BER) at Stellenbosch University, which recently increased to its highest level since its inception

- The Agbiz/IDC Agribusiness Confidence Index, which reached its highest level since inception during the fourth quarter of 2021

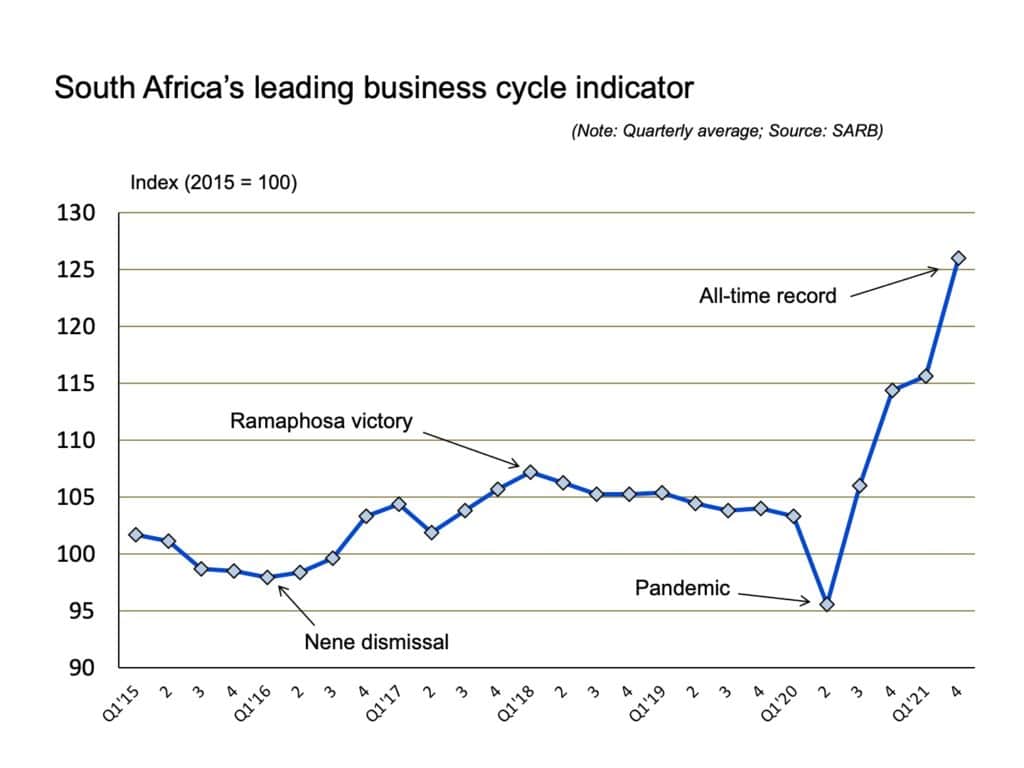

- The Reserve Bank’s composite leading business cycle indicator also reached an all-time record high during the fourth quarter of last year

When the remarkable 2022 National Budget is added to this list, it seems inevitable that South Africa’s economy will continue on the growth path established in 2021. A huge taxation revenue overrun of more than R180-billion made it possible for National Treasury to extend the Covid relief grant to millions of unemployed people, whilst also lowering government’s borrowing requirements.

South Africa enjoys a large measure of monetary stability, its fiscal situation has improved substantially and its head of state is pursuing an economic strategy aimed at closer cooperation with the private sector, including deregulation of unnecessary bureaucratic impediments to business activity. The future is looking quite rosy!