The Struggle is Real: South African Consumers’ Biggest Financial Concern Is Not Being Able to SAVE for Anything

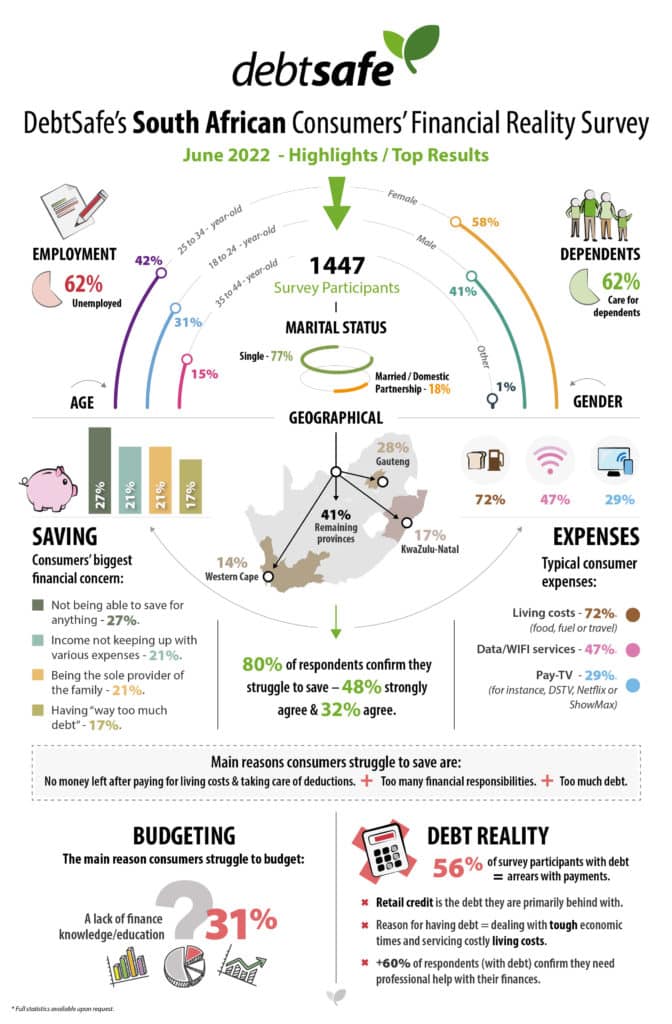

The 1400+ participants of DebtSafe’s “South African Consumers’ Financial Reality” June 2022 survey results provide various insights concerning their current financial situation.

“Consumers are experiencing dire financial times, and thus, #SavingsMonth is no celebration this year. With the escalating living costs and bills upon bills, one can understand why saving does not take priority when South Africans are fighting to survive. The biggest financial concern consumers currently have is that they cannot save for anything and the main reason is the high cost of living,”

highlights Carla Oberholzer, spokesperson and debt advisor at DebtSafe.

The survey participants’ current financial reality portrays the following (from DebtSafe’s specific, selective category survey questions. To name but a few: saving, debt and budgeting):

Personal/Background insights

- One thousand four hundred forty-seven (1447) participants contributed to DebtSafe’s “South African Consumers’ Financial Reality” June 2022 survey.

- 77% classified as being single (marital status).

- The top three (3) geographical locations/provinces of the survey participants include Gauteng (28%), KwaZulu-Natal (17%) & the Western Cape (14%).

- Most of the survey participants are currently unemployed (a shocking 62%) – confirming South Africa’s high unemployment rate and a current concerning reality.

- The 25 to 34-year-old age category reflects the biggest age group of the survey’s participants (42%).

- 62% of the survey respondents say they care for dependents (predominantly children, babies and toddlers – 68%).

- More females (58%) participated in the survey than males (41%).

Saving money

- The “biggest financial concern” consumers have is:

- Not being able to save for anything (27%).

- Income not keeping up with various expenses (21%).

- Being the sole provider of the family (21%).

- Having “way too much debt” (17%).

- A staggering 80% of respondents confirm they struggle to save – 48% strongly agree & 32% agree.

- The main reasons consumers struggle to save are:

- Not having money left after paying for their living costs and deductions.

- Having too many financial responsibilities.

- And having too much debt.

Expenses

- The top three (3) typical consumer expenses are:

- Living costs – a whopping 72% of participants confirm the high cost of food, fuel or travel.

- Data/WIFI services.

- Pay-TV (for instance, DSTV, Netflix or ShowMax).

Budgeting

Participants confirm a lack of finance knowledge/education (31%) is the main reason they struggle to budget.

Debt reality

- 56% of survey participants with debt highlight they are in arrears with their payments. And retail credit is the debt they are primarily behind with.

- Consumers confirmed their reason for having debt – dealing with tough economic times and servicing costly living expenses.

- And lastly, over 60% of respondents confirm they need professional help with their finances.

Oberholzer concludes it is evident from DebtSafe’s latest research results that consumers’ current financial reality looks bleak and dreary, and they can’t bear the financial burden alone.

Professionals and organisations (including the South African Savings Institute – SASI) have a massive task, and educational message ahead of them since consumers (especially over-indebted ones) can’t start to save for anything before their various financial obstacles are not sustainably dealt with.