For the past few weeks’ South African universities were under siege by students protesting increasing tertiary fees and student debt – until President Zuma stepped in and made an official statement that no fee rise will be enforced next year. While campuses are calming down and some classes are back to normal, the ever-present issue of student loans is still in the back of everyone’s minds.

There are a few ways to efficiently manage student debt and repayments. Once the excitement of obtaining a tertiary qualification wears off, you’re faced with enormous debt repayments – and that is discouraging.

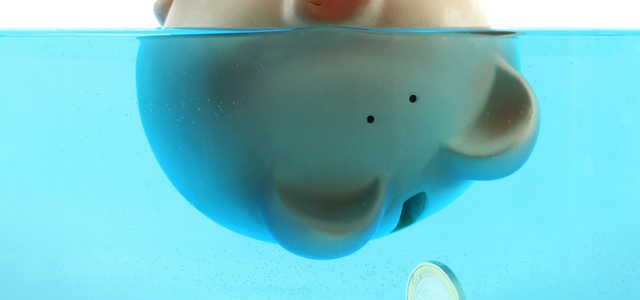

When graduates enter the job market, they are already disadvantaged by debt. The President’s decision is a major victory for students, but the government should make education more attainable and affordable. Young people are forced into debt (with student loans), and unfortunately when this continues, the country will drown in debt.

The South African government spends less money on tertiary education than any other African country. The government should increase its subsidies. Social expenditure could also be reduced to invest more money in education.

Negotiating student loans

But, even so, many will still have student loans to repay. We advise that they take their time to shop around between different financial institutions to figure out which institution offers the best deal in terms of interest rate, total loan amount to be paid and the repayment plan.

When applying for a loan, you should ask for the exact terms of the loan before it is granted. Minimize the total amount you have to borrow from a financial institution by getting some form of casual employment while you’re studying if you can. This will not only help you cover basic day-to-day costs, but will also impact the initial loan amount and save you later once you start paying the loan back.

Study loans are not normal cash loans – interest rates are fairly low and usually, you only start paying interest once you start working. As much as you may want to enjoy the pleasure of earning your first paycheque, your loan repayments should be done as soon as you are earning extra money.

You will always have the opportunity to splurge on something nice once you’re debt-free. The key is to remember the longer you take to pay off the loan, the more money you’ll have to repay. Don’t get stuck paying off huge student loans when you have a family of your own. Plus, graduates should definitely settle their student debt before they even contemplate buying a house or car.

Tips to manage student loan debt:

- Work out how much is enough. Borrow only what you need and don’t splurge on unnecessary things. Determine how much you need to cover your student costs, academic material, your cost of living and your family’s contribution.

- Draw up a budget that includes the monthly repayments you need to make. Budgeting will ensure that you not only know where your money goes each month, but also that you will remain within your financial means.

- Shop around for cheaper rates and be prepared to negotiate.

- Consider working while you’re studying. This will ensure that you won’t have to borrow as much as you originally intended. Consider tutoring, bartending or being a waiter/waitress.