South Africans’ anxiety and stress levels can be worsened by a sudden change in their financial positions or circumstances. As highlighted by DebtSafe’s 2020 Financial Reality research, a concerning amount of South African consumers experience debt or financial stress when confronted with unexpected events or crises. Over 74% of consumers confirmed a crisis (the recent COVID-19 pandemic, for example) can harm their finances, 53% pointed out it had a negative effect on their emotional well-being and 48+% added that it caused a rise in their stress levels. By creating knowledge of Mental Health Awareness Month and how to deal with financial challenges, DebtSafe offers the necessary support, in fact, four ‘financial support pillars’/tips, to help FIX consumers’ dire financial/debt-filled situations. And to, in the end, limit severe stress caused by debt.

Debt stress is nothing new. In 2019 DebtSafe’s research results confirmed that financial strain influenced 56% of the survey respondents’ stress levels. And, one of the main reasons for having debt was due to unforeseen emergencies. This year has also added more than its fair share of financial stress for consumers. Because of the unexpected COVID-19 ordeal, 25+% of this year’s 1200+ survey participants classified their emotional state of mind as being stressed-out, 20+% felt frustrated, 14+% experienced anxiety and 12+% was depressed.

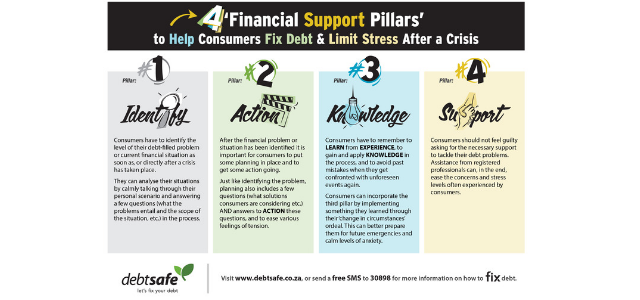

So, how can South African consumers go about when dealing with financial strain and limit debt stress, especially after an emergency or crisis has occurred? There are four recommended ‘financial support pillars’ consumers can consider and action:

PILLAR #1: IDENTIFY

First things first – consumers have to identify the level of their debt-filled problem or current financial situation as soon as, or directly after a crisis has taken place. As nerve-racking as it is, consumers have to try and take a deep breath, step aside from the negative and overwhelming feelings and prepare their thoughts for what they are about to do.

There is, unfortunately, no use in playing the ostrich and avoid the ‘confrontation’. As soon as they compose themselves as best they can, they can analyse their situations by calmly talking through their scenario and answering a few questions in the line of the following examples:

- What has just happened? (A consumer has to acknowledge that a crisis was out of his/her control, but that he/she can get a grip on the situation/get her/his head around the situation. This can ease unnecessary anxiety in the process.)

- What is the best way to deal with this sudden change? (This question can motivate consumers to make room for some brainstorming aka preparing themselves that a plan is about to take place.)

- What is the best way to recognise/pinpoint those stress-related emotions and dealing with the financial situation in the process? (Consumers are familiar with their own needs, and know what can work and what won’t work for them.)

- Is there enough household income still available this month/these upcoming months? (Getting their head around the entire financial situation and implications.)

- What do their various expenses entail and how many bills need to get paid/’serviced’? (Referring to credit agreements, debit orders or service agreements, etc.)

By asking the above types of questions, consumers can soon realise the scope of their financial situation and identify existing or possible future complications that they may encounter. And, by working through this identification process or various questions, they can limit their rising stress levels since they are working proactively on a strategy to do something about their financial problems.

PILLAR #2: ACTION

After the financial problem or situation has been identified it is important for consumers to put some planning in place and to act. Just like identifying the problem, planning also includes a few questions AND answers to ACTION these questions, for example:

- What areas can be explored or considered to cut expenses? (Limiting items on shopping lists, using less energy-hungry household appliances, or cancelling unnecessary subscriptions, for example. These types of solutions can also calm the consumer – knowing that action is taking place to help fix the situation and NOT make it worse.)

- What can each member of the household do to save more money OR boost the current household income? (Using less fuel by making fewer travel trips and adding those savings to other NEEDS/bills and not WANTS, or by using available resources and entrepreneurial skills to add money to the household’s ‘financial bucket’, for example. The feeling of unity and support is indeed helpful to ease frustration, anxiety, and stress.)

PILLAR #3: KNOWLEDGE

Sudden changes in circumstances can give consumers the opportunity to better plan for their financial future. Yes, dealing with change is not easy but seeing the experience as a learning curve can indeed set forth a boost of confidence to be better prepared for any future financial problem or misfortune. Consumers have to remember to LEARN from EXPERIENCE, to gain and apply KNOWLEDGE in the process, and to avoid past mistakes when they get confronted with unforeseen events again.

An example? Consumers can incorporate the third pillar by implementing something they learned – to start an emergency fund, for example. Even though it is a tiny amount that they tuck away at first, they will know that it can make a difference in the future when they need to deal with an unexpected event. By being better prepared for a change in financial circumstances can surely limit and lower those stress levels.

PILLAR #4: SUPPORT

As the regulating body of the credit industry aka National Credit Regulator (NCR) highlights – consumers should not go it alone and rather get the necessary debt counselling that they need to not allow any more suffering, anxiety, or drowning in severe debt to occur. Professionals, such as financial planners, bankers, and registered debt counsellors are a phone call or e-mail away from helping consumers to fix their debt-filled situation. Consumers should not feel guilty asking for the necessary support to tackle their debt problems. Assistance from the right professionals can, in the end, ease the concerns and anxiety often experienced by consumers.

Financial situations and stress can hold consumers captive from a healthy and debt-free life. By raising awareness and in response to Mental Health Awareness Month, DebtSafe urges consumers to take care of themselves and try to limit their stress levels by using the above four ‘support pillars’ when or after dealing with a crisis/change in their circumstances. In severe cases of mental health being affected, consumers are urged to get the necessary help from professionals in the Health Care field sooner rather than later.