Welcome to the wild world of debt! It’s a place where every type of debt has its own vibe, just like a character from your favourite movie or TV show. This blog explores debt’s different personalities as famous fictional characters.

We’ll use fun comparisons to help you understand your debt better. So, grab your popcorn, settle in, and get ready to learn how to turn those debt villains into sidekicks in your own financial story!

1 – Credit Card Debt

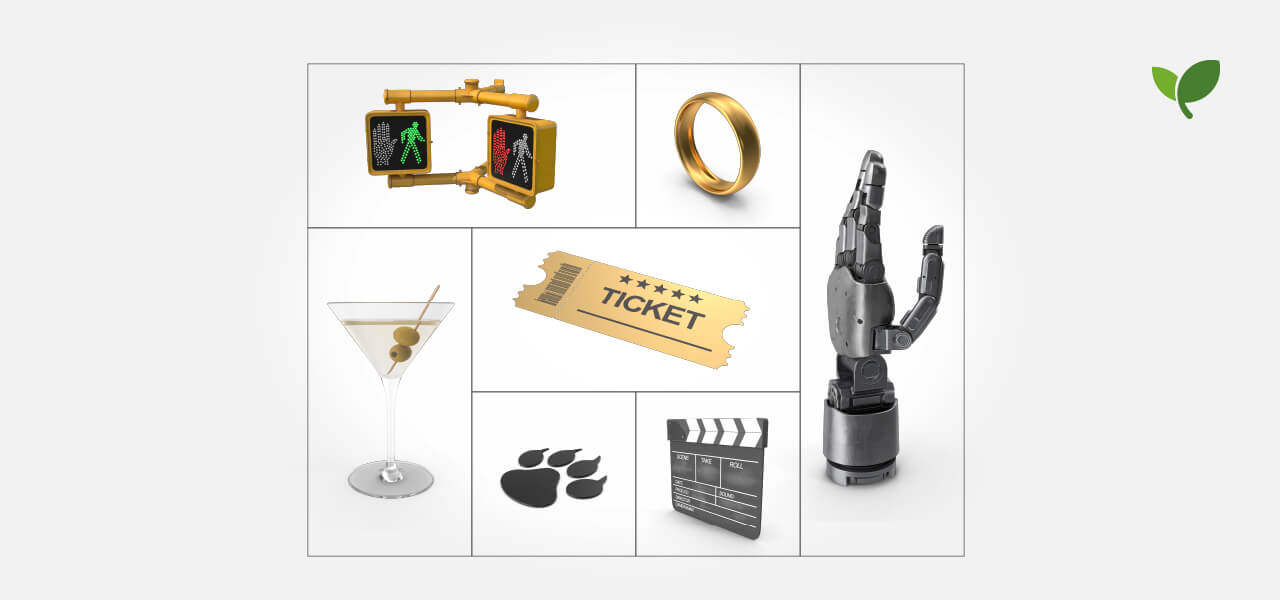

Gollum: And his precious one ring.

While holding your credit card…”my precioussss”

Credit Card debt, personified, could be depicted as the relentless pull of the one ring in The Lord of the Rings.

Like the allure of the one ring, owning a credit card may initially appear to be a good, harmless thing. However, just as Gollum’s obsession with the ring made him utterly reliant on it, the frequent use of credit cards can escalate to a point where we become entirely dependent. Before we know it, we find ourselves trapped in a cycle of debt, just like poor Gollum, who lost everything because of one shiny ring.

So, if you have a credit card, set a budget, prioritise payments, avoid unnecessary usage, and always pay more than the minimum to reduce interest charges. Remember, the money on the credit card is the bank’s money, not yours, just like the ring wasn’t actually Gollum’s; it was Sauron’s… let that sink in…

2 – Home Loan Debt

7de Laan: The Homeownership Drama

Is being a homeowner A-For-Away, or is it drama-filled?

Owning a home is like 7de Laan (RIP): It is a comfort, but it’s also filled with never-ending drama.

Being a homeowner means facing financial twists and turns—just like a soapy! From the standard ongoing bond payments and property taxes to unexpected maintenance costs, it’s like having one of Hilda’s famous concoctions; you must take the sweet with the sour.

Having a home loan is a big responsibility, so ensure it is at the top of your list by setting up automatic payments. Also, allocating a portion of your monthly budget towards house maintenance is crucial. Delaying maintenance can result in higher expenses and more unnecessary drama in the future.

3 – Car Loan Debt

James Bond: Or rather, James Budget.

Debt that will have you shaken and stirred.

Most of us would love to have Bond’s famous, flashy, luxurious, gadget-filled Aston Martin. Keep in mind that MI6 funds his car, and it is safe to say most South Africans’ pockets do not run that deep!

Still, the allure of a flashy car remains. Considering the monthly payments, maintenance costs, fuel hikes, and unique challenges of driving a vehicle on South African roads will make you feel like James Bond facing formidable foes on a daily basis.

So, resist the allure of the flashy car. Instead, choose wisely and prioritise reliability and budget over unnecessary upgrades. You don’t have to save the world with your car, but choosing sensibly can save you a lot of financial trouble in the long run.

4 – Payday Loan Debt

Wile E. Coyote (with ACME Instant Cash)

Meep meep! There goes your money.

Wile E. Coyote’s reliance on ACME gadgets to catch the Road Runner always backfired spectacularly, it literally never works!

Similarly, payday loans might seem like a quick fix, but the sky-high interest rates and short repayment terms can leave you worse off than Wile E. after falling off a cliff, running full speed into the rockface, and having an anvil land on his head.

Taking out a payday loan is almost always a bad idea. It can quickly blow up in your face like ACME TNT, so avoid it if you can. Always explore all your options before making a decision. And if you have a payday loan, focus on paying it off as soon as possible to minimise interest charges.

5 – Student Loan Debt

The Terminator

Hasta la vista, money!

Student loans are like cyborgs in The Terminator—relentless, unstoppable, and determined to collect. They haunt your dreams, follow you into your first job, and tell you, without uncertainty: “I’ll be back…for your pay check.”

But just like the different cyborgs in the movie, student loan debts are, on the one hand, a big menacing challenge, like the T-1000. However, they can also provide you with the means to a better future, helping you toward your destiny like Terminator. And as you progress in your career and salary, you will have more resources to pay off the debt. Just remember to prioritise the payments!

6 – Personal Loan Debt

The Squid Games You Didn’t Sign Up For

Red light, green light…no end to debt in sight

Like the tempting cash prize in Squid Games, a personal loan tempts you with the allure of immediate funds to fulfil your desires or address a pressing need.

But like the contestants in Squid Games, you need a clear strategy to avoid getting eliminated (financially speaking). Just as the games are fraught with hidden dangers and unexpected twists, personal loan debt often comes with high-interest rates, fees, and penalties that can quickly accumulate, becoming a significant financial burden.

Moreover, like the relentless pursuit of survival in the Squid Games, personal loan debt can be difficult to escape once trapped in a cycle of borrowing more money to pay your debts.

Never just accept a loan offer. First, determine what you need, if you actually need it, and how you will repay it realistically. Then shop around for the best rates. Never use a personal loan to buy unnecessary stuff you want. Use personal loans strategically, and you can win the financial game!

7 – Store Card Debt

Charlie and the Chocolate Factory

You found the golden ticket….to debt!

Store card debt can feel a bit like winning the golden ticket to Willy Wonka’s fantastical wonderland—a place where everything seems delightful and within reach. And just like the over-the-top opulence mesmerised the characters, we get carried away by the access to the shiny world of stuff.

Those “no interest for X months” deals make it easy to get carried away. Before you know it, the magical feeling of your shopping spree is gone, and you’re left to pay for things for many, many months that you cannot even remember buying!

So just like Charlie Bucket resisted the temptation of going overboard, you also need to resist temptation. Scrutinise those store card offers – are they truly worth it? Can you afford it? Do you need it? Create a budget and stick to it!

Debt is a part of life, and the different kinds of debt can feel as diverse as a cast of characters from a TV show or movie. The key is understanding your cash flow limits, creating a budget, and prioritising your payments.